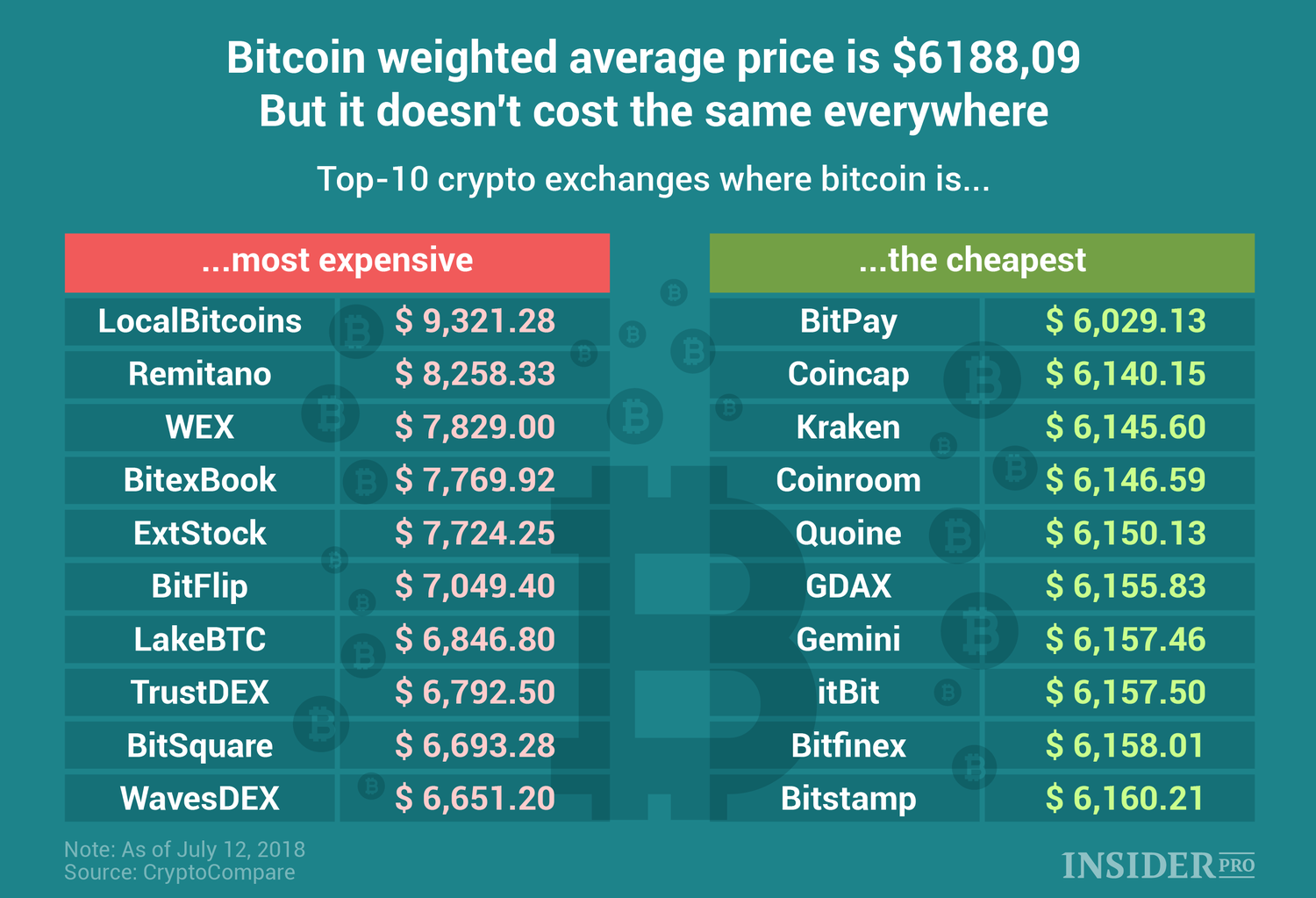

Cryptocurrency bitcoin price

These sorts of examples are another big draw of SHIB, with its supply quite intentionally set to the very high figure of 1 quadrillion. This means that investors can own millions, if not billions, and even trillions, of the tokens https://online-casinos-usa.org/.

Shiba Inu coin was created anonymously in August 2020 under the pseudonym “Ryoshi.” Ryoshi says about himself that he is a nobody and not important and that the efforts to unmask his identity, even if successful, would be underwhelming.

These BONE tokens are both generated by and used in DeFi on the ShibaSwap DEX. Although BONE wasn’t intended to be a governance token, that’s how the community has been using it at the time of writing.

In January 2023, the Shiba Inu community leadership introduced Shibarium, a layer two blockchain designed to run on top of Ethereum. This update was released to reduce congestion, introduce staking into the ecosystem, lower gas fees, and provide a framework for decentralized applications and Web 3 expansion.

Cryptocurrency bitcoin price

These halvings and the predefined nature of Bitcoin’s supply make Bitcoin’s monetary supply almost perfectly transparent. This stands in stark comparison to fiat currency which is simply printed, and increasingly so in recent years, by central bankers across the world.

The top crypto is considered a store of value, like gold, for many — rather than a currency. This idea of the first cryptocurrency as a store of value, instead of a payment method, means that many people buy the crypto and hold onto it long-term (or HODL) rather than spending it on items like you would typically spend a dollar — treating it as digital gold.

A hard fork is a protocol upgrade that is not backward compatible. This means every node (computer connected to the Bitcoin network using a client that performs the task of validating and relaying transactions) needs to upgrade before the new blockchain with the hard fork activates and rejects any blocks or transactions from the old blockchain. The old blockchain will continue to exist and will continue to accept transactions, although it may be incompatible with other newer Bitcoin clients.

These halvings and the predefined nature of Bitcoin’s supply make Bitcoin’s monetary supply almost perfectly transparent. This stands in stark comparison to fiat currency which is simply printed, and increasingly so in recent years, by central bankers across the world.

The top crypto is considered a store of value, like gold, for many — rather than a currency. This idea of the first cryptocurrency as a store of value, instead of a payment method, means that many people buy the crypto and hold onto it long-term (or HODL) rather than spending it on items like you would typically spend a dollar — treating it as digital gold.

A hard fork is a protocol upgrade that is not backward compatible. This means every node (computer connected to the Bitcoin network using a client that performs the task of validating and relaying transactions) needs to upgrade before the new blockchain with the hard fork activates and rejects any blocks or transactions from the old blockchain. The old blockchain will continue to exist and will continue to accept transactions, although it may be incompatible with other newer Bitcoin clients.

Cryptocurrency

Cryptocurrency prices are much more volatile than established financial assets such as stocks. For example, over one week in May 2022, bitcoin lost 20% of its value and Ethereum lost 26%, while Solana and Cardano lost 41% and 35% respectively. The falls were attributed to warnings about inflation. By comparison, in the same week, the Nasdaq tech stock index fell 7.6 per cent and the FTSE 100 was 3.6 per cent down.

On 19 October 2021, the first bitcoin-linked exchange-traded fund (ETF) from ProShares started trading on the NYSE under the ticker “BITO.” ProShares CEO Michael L. Sapir said the ETF would expose bitcoin to a wider range of investors without the hassle of setting up accounts with cryptocurrency providers. Ian Balina, the CEO of Token Metrics, stated that SEC approval of the ETF was a significant endorsement for the crypto industry because many regulators globally were not in favor of crypto, and retail investors were hesitant to accept crypto. This event would eventually open more opportunities for new capital and new people in this space.

The term “physical bitcoin” is used in the finance industry when investment funds that hold crypto purchased from crypto exchanges put their crypto holdings in a specialised bank called a “custodian”.

Top cryptocurrency

People have shown a growing interest in digital assets—a significant shift from mere curiosity to genuine engagement. While there are still many challenges surrounding regulatory frameworks, interest in crypto isn’t slowing down. With thousands of cryptocurrencies and high competition, the big question arises: Which is the best crypto to invest in?

Cryptocurrency is a form of currency that exists solely in digital form. Cryptocurrency can be used to pay for purchases online without going through an intermediary, such as a bank, or it can be held as an investment.

While you can invest in cryptocurrencies, they differ a great deal from traditional investments, like stocks. When you buy stock, you are buying a share of ownership of a company, which means you’re entitled to do things like vote on the direction of the company. If that company goes bankrupt, you also may receive some compensation once its creditors have been paid from its liquidated assets.

When choosing the best cryptocurrency to invest in, it is important to consider your individual goals, investing timeline and risk profile, just as you would with any investment. Additionally, you should do your due diligence to make sure that any crypto project you are interested in is legitimate and secure.

Rae Hartley Beck first started writing about personal finance in 2011 with a regular column in her college newspaper as a staff writer. Since then she has become a leader in the Financial Independence, Retire Early (FIRE) movement and has over 300 bylines in prominent publications including Money, Bankrate and Investopedia on all things personal finance. A former award-winning claims specialist with the Social Security Administration, Rae continues to share her expert insider knowledge with Forbes Advisor readers.